Customer profile

A leading financial services group based in the United Kingdom, providing a wide range of banking and financial services. The company serves millions of personal and business customers with a comprehensive portfolio of products, including retail and commercial banking, wealth management, and insurance services. With a strong focus on innovation and customer service, the organization plays a vital role in supporting the financial well-being of individuals and businesses across the UK and beyond.

The Challenge

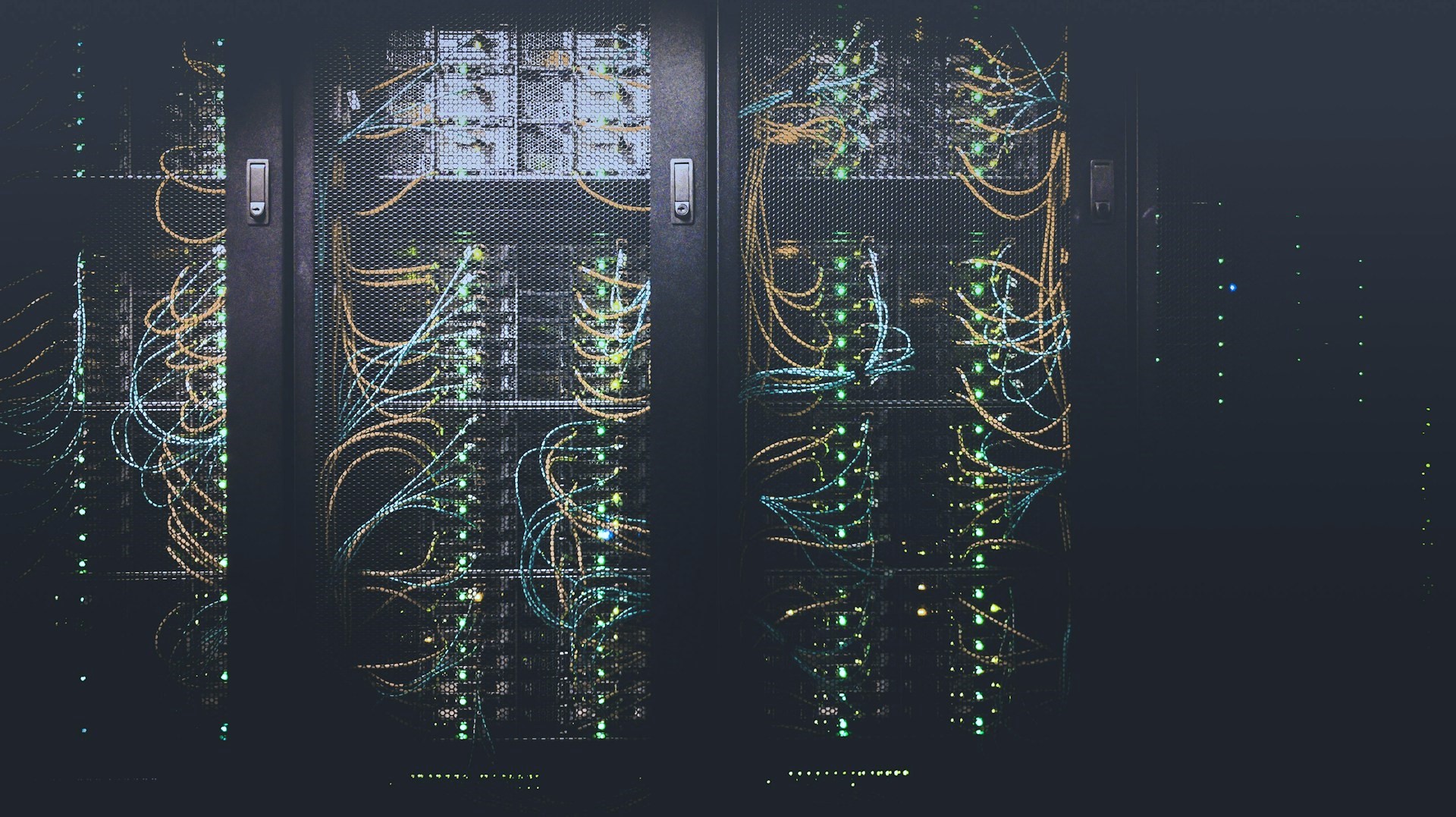

Our client, a major player in the financial sectors, faced significant challenges in delivering and assuring large-scale programs through shorter, focused engagements. He required robust architectural governance frameworks to ensure compliance with industry standards, and optimal solutions for his diverse capabilities and requirements. Additionally, in-depth network architecture assessments were essential to identify and mitigate potential vulnerabilities and stability concerns.

Our Approach

To address these challenges, we implemented a comprehensive strategy that included:

- Architectural Governance: Defined and implemented governance frameworks to ensure compliance and alignment with industry standards.

- Solution Modelling: Modelled solutions based on various capabilities and requirements to provide the most optimal configurations and integrations.

- Network Assessments: Conducted thorough network architecture assessments to identify vulnerabilities and stability issues, providing actionable recommendations.

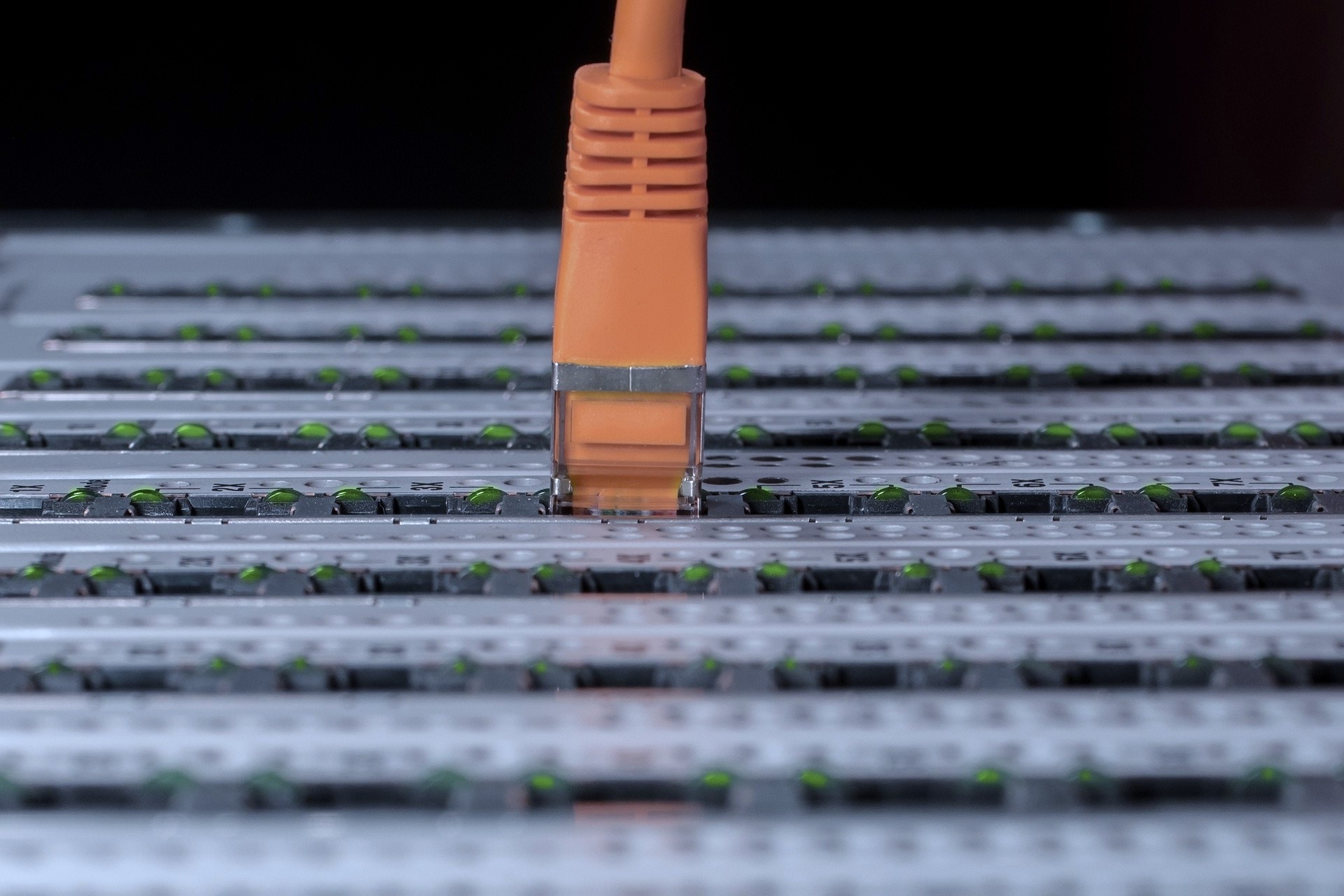

- Security Integration: Integrated SOC/SIEM solutions and developed detailed security plans, procedures, and playbooks to address threats such as ransomware, data leaks, malware, and DDoS attacks.

- Strategic Advising: Offered strategic advice to improve security and resolve stability issues for SDN solutions supporting commercial and global market services.

- Regulatory Compliance: Authored and submitted detailed technical reports to regulatory bodies, such as the European Central Bank (ECB), ensuring compliance and adherence to industry best practices.

The Results

- Enhanced Security: Successfully integrated advanced DDoS mitigation systems and developed robust security frameworks, significantly enhancing the security posture of client networks.

- Regulatory Compliance: Contributed to regulatory compliance through detailed technical reports and adherence to industry best practices, meeting the stringent requirements of the European Central Bank (ECB).

- Operational Stability: Improved the stability and resilience of network architectures, ensuring continuous and reliable service delivery.

- Strategic Improvements: Provided strategic improvements and resolutions to security and stability issues, supporting the efficient operation of commercial and global market services.